Your reporting breaks the moment

the business gets complicated —or the person holding it together leaves.

Prexisio builds and maintains your data environment so reporting stays defensible — regardless of what changes, what breaks, or who leaves.

We own the data chain end-to-end — integrations, definitions, recurring delivery — inside your environment, under your accounts. Your team uses the outputs. We stay responsible for them.

Teams call us when

- Reporting breaks under growth or system change

- Different teams show different numbers

- Close, board, or audit deadlines are at risk

- The person holding it together is gone

Reporting holds when things change

System upgrades, team changes, new entities — the numbers keep running. Nothing breaks because one person left or one tool changed.

Deadlines stop being fire drills

Close, board, lender, audit, billing — they run on schedule. Problems surface before the deadline, not during it.

One number. Every room.

Finance, ops, and leadership pull from the same governed foundation. Meetings become decisions instead of reconciliation sessions.

One person knows how your reporting actually works.Everything else is held together by memory and habit.

It's not a technology problem. It's a dependency problem. Somewhere in your organization, one analyst built the logic, one finance lead owns the macros, one ops person knows which export to run and when. The system works — until it doesn't. And you won't know how exposed you are until the moment you can least afford to find out.

When the chain is fragile, everything downstream breaks

Board pack becomes a negotiation

The same KPI shows up three different ways depending on who built the report. Meetings become reconciliation sessions instead of decisions. The CFO spends the hour defending numbers instead of using them.

Close drifts as the business grows

More entities, locations, payers, SKUs, projects. Someone is manually stitching it together in a spreadsheet the night before it's due — and everyone in the room knows it.

Billing and cash leak quietly

WIP, A/R, charge capture, utilization, or SLA reporting doesn't reconcile. Disputes rise. Cash predictability drops. Nobody flags it because nobody owns it.

Reporting stops when people do

The analyst gives notice. The finance lead goes on leave. And suddenly the reports that ran every month for three years — nobody knows how to run them. The knowledge was never written down because there was never time.

The moment it becomes urgent

Most teams live with fragile reporting for years — until something forces the issue. A new CFO or COO walks in and asks for a clean set of numbers. An acquisition closes and the acquirer wants consolidated reporting in 30 days. A key analyst gives two weeks notice. An ERP migration breaks every export. A lender tightens covenant reporting.

None of these are surprises. They're predictable events that expose a dependency that was always there — and that nobody had time to fix while everything was technically running.

What it looks like when it's fixed

A finance team running NetSuite, Adaptive, and Salesforce had been manually reconciling FP&A reports for months — three systems, one analyst, no documentation. We integrated all three into a single governed data foundation, automated recurring reporting, and built runbooks so any hire could maintain it. The analyst stayed. The dependency didn't.

Mid-market teams don't fail because they lack tools.

They fail because nobody owns the data environment end-to-end — ingestion, definitions, and recurring delivery.When accountability is fractured, reliability becomes optional.

Trusted by

Companies who've replaced fragile reporting with reliable data foundations

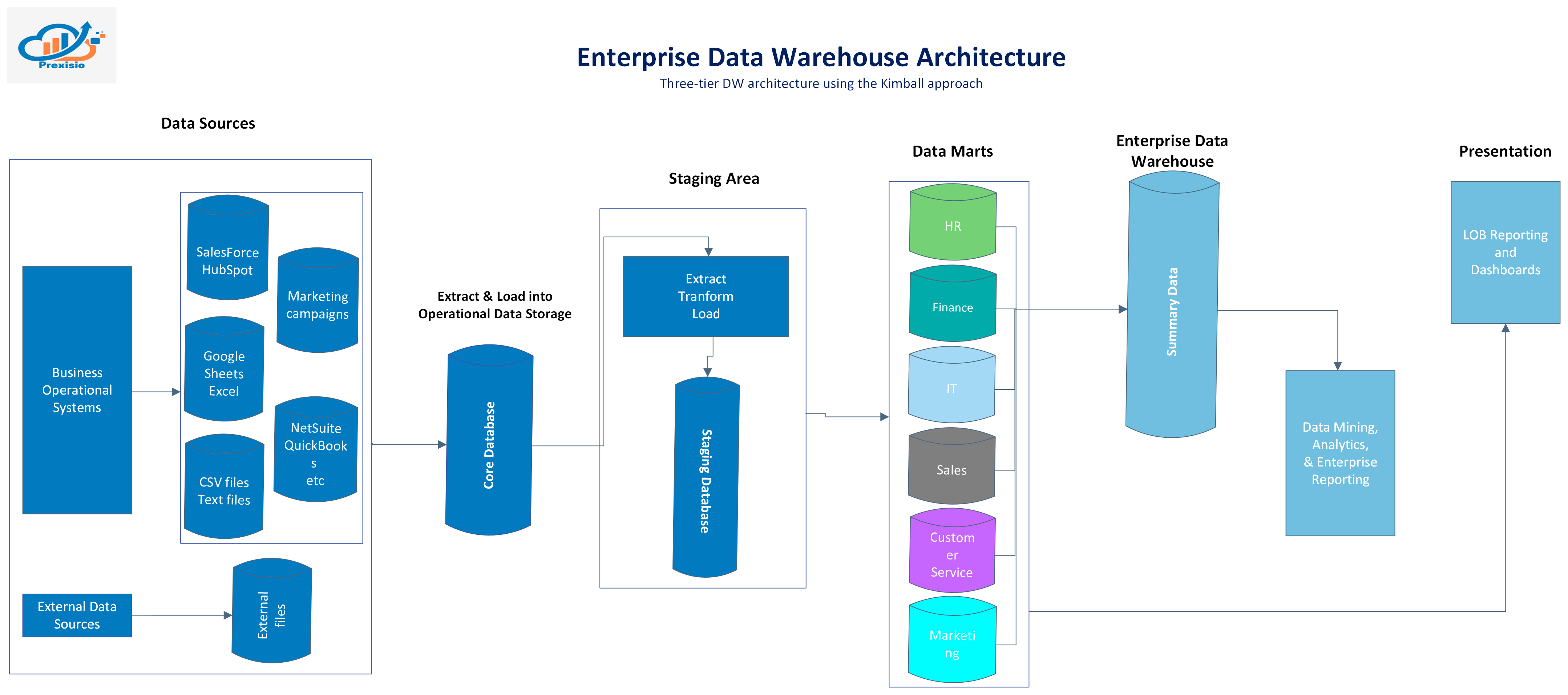

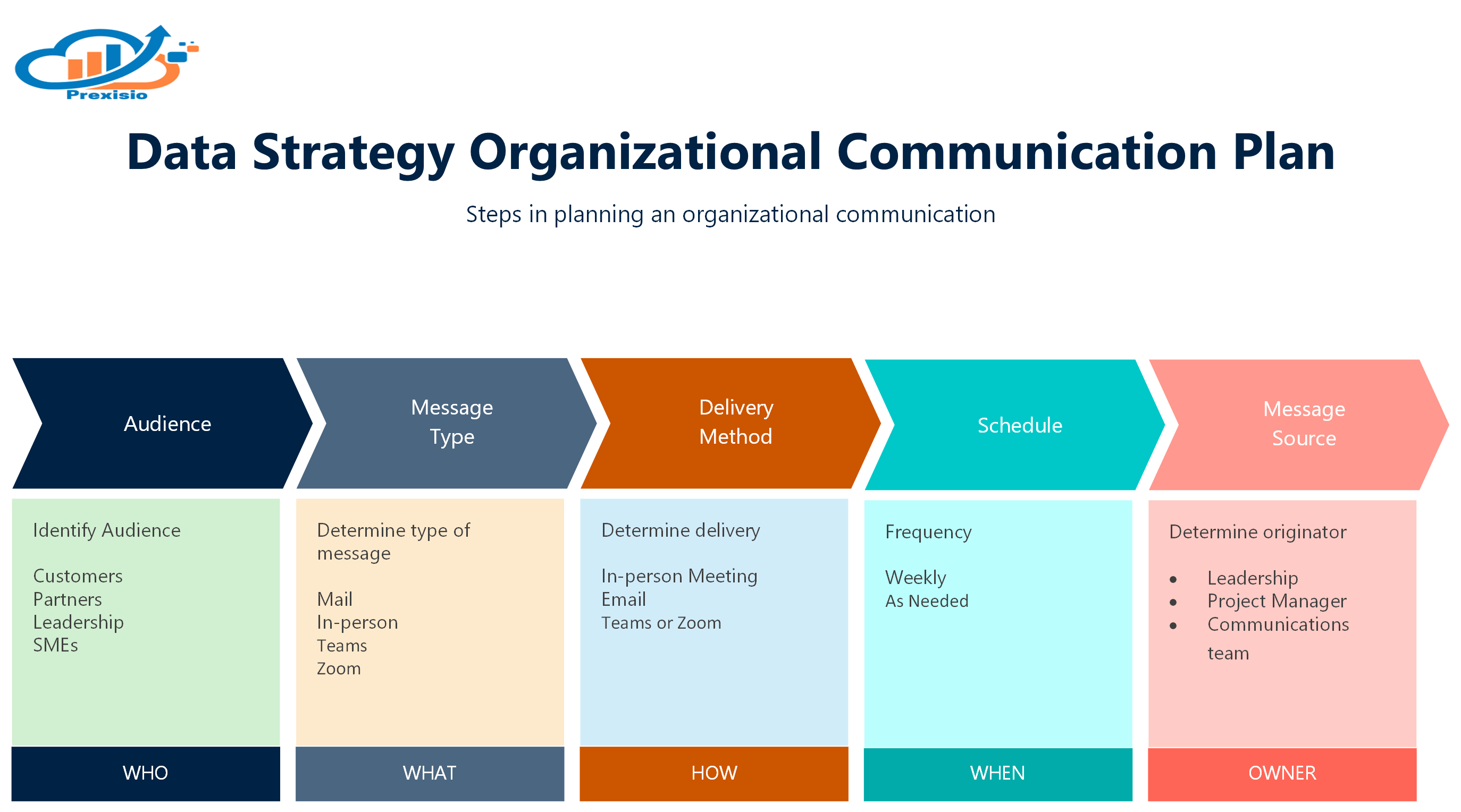

This is what the infrastructure looks like

when it's built to hold.

Real deliverables from active engagements. The architecture diagrams, the dashboards, the strategy documents — this is the work.

| Owner | Active | Approved | Variance |

| Operations Lead | 98 | 102 | 4 |

| Sales Director | 72 | 75 | 3 |

| R&D Head | 48 | 48 | 0 |

| Finance VP | 31 | 35 | 4 |

| Total | 261 | 284 | 23 |

Dashboard data anonymized. Architecture and strategy documents reflect actual Prexisio deliverables.

The data chain Prexisio owns end-to-end

Most data problems aren't solved by better tools.They're solved by someone who owns the outcome and doesn't leave.

Prexisio builds and runs your data environment end-to-end — integrations, definitions, validation, recurring delivery — inside your infrastructure, under your accounts.You own the system. We stay responsible for what it produces.

✓What we do

- Integrate your source systems and implement automated ingestion

- Model and standardize definitions so numbers mean the same thing everywhere

- Operationalize recurring outputs so they stay correct as the business changes

- Monitor, validate, and fix before deadlines expose failures

- Own delivery cadence for close, board, lender, audit, billing, and SLA cycles

✗What we don't do

- Advice-only engagements with no operational accountability

- One-time dashboard builds we hand off and walk away from

- Ad-hoc analysis projects with no ownership of the underlying system

- Staff augmentation inside someone else's plan

- Engagements where we have no authority to standardize definitions

If accountability is split, reliability stays optional.

What changes

The board meeting changes

One set of numbers. Same definitions in every report. Decisions happen instead of reconciliation.

Close stops being a fire drill

Recurring outputs run on schedule. No manual stitching the night before. No stale numbers in the morning.

People can leave without breaking things

The system is documented, governed, and maintainable by anyone. A departure is an HR event, not an operational crisis.

You stop inheriting breakage

When a system changes or a definition drifts, we catch it before a deadline exposes it. You find out from us, not from the board.

Why this works when the usual options don't

Hiring

You replace one single point of failure with another. The new hire learns the system, rebuilds the logic in their own way, and now the dependency has a different name. Same exposure, higher cost.

One-off consulting

They build something solid, hand over documentation nobody fully understands, and leave. Six months later the business has changed, the system hasn't, and you can't touch it without calling them back.

Build + maintain

We keep operating the system as the business changes. Reliability holds because the people who built it are still responsible for it.

You don't need more tooling.

You need one team that owns the chain, stays responsible for the output, and is still there when something breaks.

This is for you if you get blamed when the numbers are late, wrong, or indefensible.

We integrate your systems, implement governed definitions, and operationalize recurring outputs inside your environment.We are accountable for reliability and on-time delivery.

Non-negotiable: we need access and authority to standardize definitions and operate the system.

You're a fit if

Accountability gap is obvious

- Reporting depends on tribal knowledge or one spreadsheet owner

- No one is responsible for data intake, definitions, reliability, and delivery together

- When systems change, numbers drift and no one knows where to fix it

Deadlines have consequences

- Close, board packs, lender reporting, audit, payroll, or billing cannot slip

- Customer SLA reporting affects renewals, penalties, or trust

- Leadership challenges numbers and your team cannot defend them quickly

Complexity crossed a threshold

- 5+ systems must reconcile (ERP, billing, CRM, ops tools, spreadsheets)

- Multi-entity, multi-location, or PE reporting requirements

- Growth turned manual workarounds into recurring fire drills

You want it off your plate

- You want one team accountable for reporting reliability

- You want continuity through turnover, migrations, and process change

- You want reliable recurring reporting without expanding headcount

Plain truth

If you want to keep control but outsource blame, nothing improves. One team must own the data chain end-to-end with real authority.

Not a fit if

- You want a one-time dashboard build

- You want advice or strategy decks, not execution

- You want staff augmentation or someone to follow your internal plan

- You are fine with late reporting or inconsistent definitions

- You want to keep the work and risk in-house

- You want us to operate without authority to standardize definitions

- You want accountability without granting access or decision rights

You already know something is broken.Let's figure out if we're the right team to fix it.

If growth, change, or turnover just exposed the cracks, we can stabilize your data environment in 60–90 days and keep reporting reliable.If you later bring it in-house, nothing migrates. We simply step back.

Which breaking point brought you here?

Send a quick note with:

This is how we make the first call worth your time.

- What broke: system change, scale, turnover, deadline pressure, trust collapse

- Must-not-fail outputs: close pack, board pack, lender reporting, audit, billing, SLAs

- Systems involved: ERP, CRM, billing, ops tools, spreadsheets, data feeds

- Deadline: next close, board date, audit, lender package, renewal, billing cycle

We'll respond within one business day or tell you we're not the right fit.